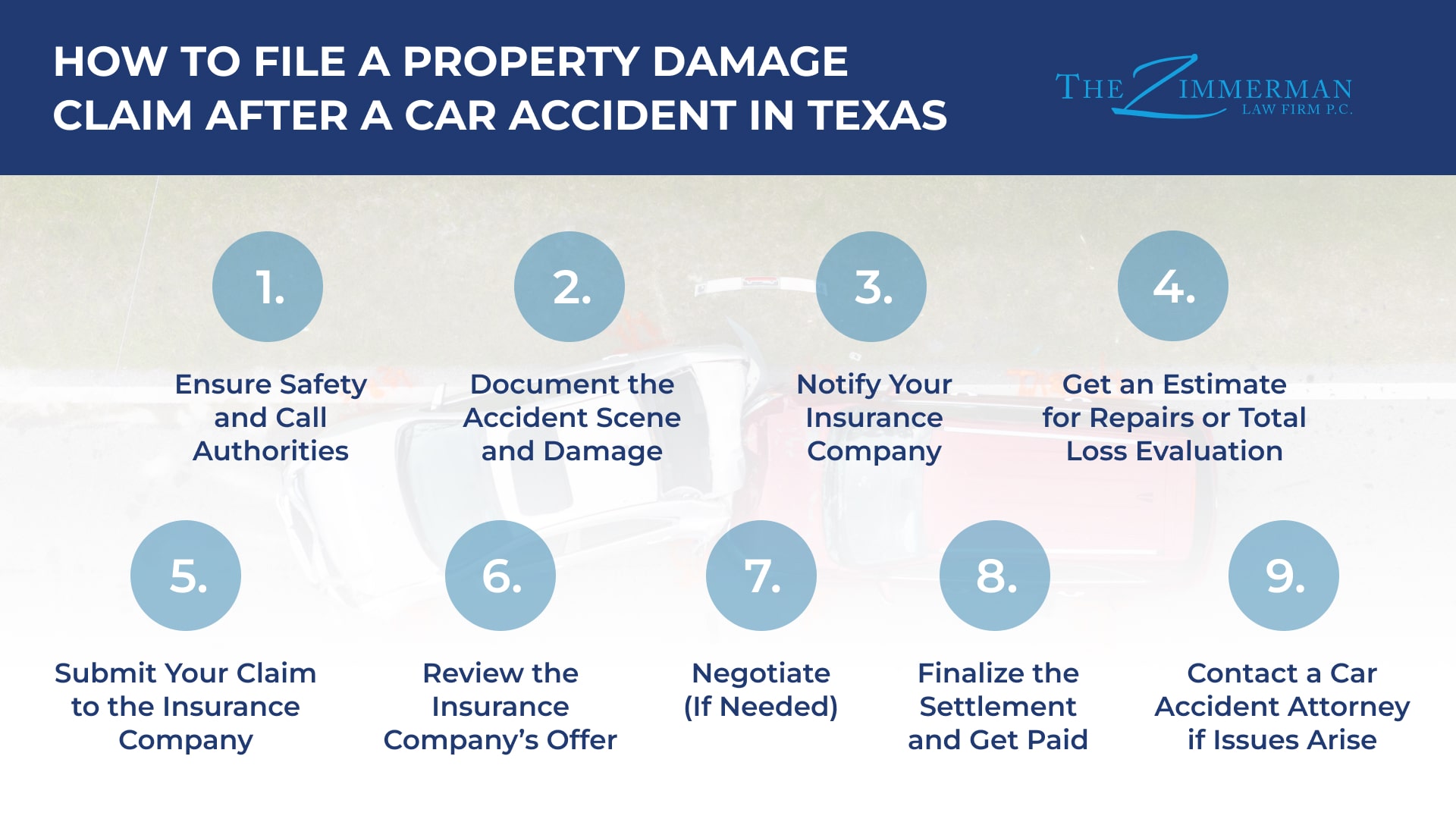

As a Lone Star State motorist, you have the legal right to property damages after a car accident.

Understanding the types of property damage claims available can make the aftermath less stressful and ensure you recover the financial losses you’re entitled to.

Below, our Waco car accident lawyers will go over those property damage claims you can claim after a car accident in Texas. If you have questions, contact us online today or call us at 254-752-9688.

What Are the Most Common Types of Property Damage Claims?

Personal Items

Property damage in a car accident can include personal items inside the car that were damaged, like your laptop or smartphone.

Be sure to document these items and their value and include them in your property damage claim.

Transportation Costs

In Texas, most insurance policies cover the reasonable costs of alternative transportation—such as public transportation or rental cars—when your vehicle is totaled or in the repair shop.

Coverage usually lasts for however long your vehicle is out of commission up to a certain limit.

Vehicle Damage

Vehicle damages cover repair costs, including bodywork, paint jobs, and structural repairs needed to restore your car to its pre-accident condition.

These costs can vary based on your vehicle’s make and model, the extent of the damage, the repair shop’s rates, and the parts used in the repair.

Diminution in Value

Diminished value typically refers to the reduction in a vehicle’s market value after repairs.

There are several types of diminished value claims; however, some Texas insurance policies explicitly eliminate this type of coverage.

If you believe you have a valid claim for diminished value, it’s advisable to consult with a knowledgeable car accident attorney.

Market Value

If your car is completely totaled, its market value will determine its replacement value. Market value is what your car would be worth if it were for sale before your accident, minus its salvage value.

A vehicle’s market value in Texas depends on the county where the auto accident occurred.

For example, say you drive a 2015 Ford F-150 and get into an accident in Harris County, where there’s a strong demand for used Ford trucks. In this case, where similar used vehicles sell for around $25,000, the insurance company will likely use this amount as the pre-accident fair market price.

However, the insurance company could offer less if you’re in the same accident in a remote county like Loving County, where the sparse population results in low truck demand and prices.

Essentially, insurance companies use your location to identify comparable sales and assess the local used car market.

They then apply this information and other factors like the vehicle’s age, mileage, overall condition, and improvements or upgrades you’ve made to determine a settlement amount.

Call (254) 752-9688 to speak with our car accident lawyers or fill out the free case evaluation form below

Get the Compensation You Deserve for Your Car Accident Property Damage Claim – 100% Free Consultation

When you work with The Zimmerman Law Firm, you can rest assured that our award-winning car accident attorneys will handle your property damage claim with the passion and know-how your case deserves.

With over a century of combined experience, our skilled advocates have won over nine million dollars in verdicts and settlements for our clients—now let us go to bat for you.

Contact us online today or call us at 254-752-9688 for a free consultation.