When deciding on the best way to establish your new Texas business, it’s important to distinguish between a doing business as (DBA) designation and a limited liability company (LLC). These are distinct legal concepts that can overlap, leading to potential confusion.

Understanding their differences is crucial for making informed decisions about your business. Choosing the right (or wrong) structure can significantly impact your business’s liability, taxes, and management flexibility.

Entrepreneurs may need clarification about the differences when starting a business venture to ensure they pick the right path to achieve their goals. Let’s look closer at DBAs vs. LLCs in Texas, how they work, and how the business law attorneys at The Zimmerman Law Firm can support your goals.

What Is an LLC?

An LLC is a popular business structure in Texas due to its flexibility and liability protection. It combines the benefits of a corporation and a partnership, offering limited liability to its owners (called members) while allowing for pass-through taxation. Forming an LLC in Texas involves several steps, including:

- Choose a name. Your LLC must have a unique name that complies with Texas naming requirements, which can be found on the Texas Secretary of State’s website.

- File a certificate of formation. Submit a certificate of formation to the Texas Secretary of State, providing details about your LLC, including its name, purpose, management structure, and registered agent.

- Appoint a registered agent. Designate a registered agent with a physical address in Texas to receive legal documents on behalf of the LLC. Having a registered agent is required under Texas law.

LLCs offer Texas business owners several advantages, including limited liability, where members are not personally liable for the LLC’s debts and obligations. LLCs also benefit from pass-through taxation, meaning that profits and losses “pass through” the LLC and are reported on the members’s personal tax returns.

Furthermore, LLCs provide flexibility in management, allowing members to choose between managing the LLC themselves (member-managed) or appointing managers (manager-managed).

However, LLCs require more paperwork and formalities than sole proprietorships or partnerships, which can increase the business’s operational complexity.

What Is a DBA?

A DBA designation is a registered trade name that allows a business to operate under a name different from its legal name. Unlike an LLC, a DBA is not its own separate business entity; it is also known as an assumed or fictitious name.

The DBA enables businesses to create a distinct brand identity without forming a separate legal entity, such as a corporation or an LLC. Filing a DBA in Texas includes:

- Choosing a name. Select a unique and distinguishable name that conveys your business’s purpose and goals and complies with state law.

- Filing an assumed name certificate. Submit an assumed name certificate to the county clerk’s office in each county where the business operates. The certificate must include the business name, owner’s name and address, and a statement that the business is under an assumed name.

- Publishing a notice. Texas law also requires you to publish a notice of the assumed name in a local newspaper for a specified period.

Unlike an LLC, you do not need to file paperwork with the Texas Secretary of State’s office to register your DBA. Using a DBA offers several benefits, such as:

- Cost-effectiveness—registering a DBA is generally less expensive than forming a separate legal entity and requires fewer formalities;

- Flexibility—allows businesses to operate under a different name without the formalities associated with forming a new entity; and

- Brand recognition can help businesses establish and promote a unique brand identity that might not necessarily be their “official” name.

However, there are drawbacks. Because DBAs don’t offer legal protection for your business name, another legal entity could use the same or a similar name. In addition, unlike corporations or LLCs, DBAs don’t provide limited liability protection for business owners.

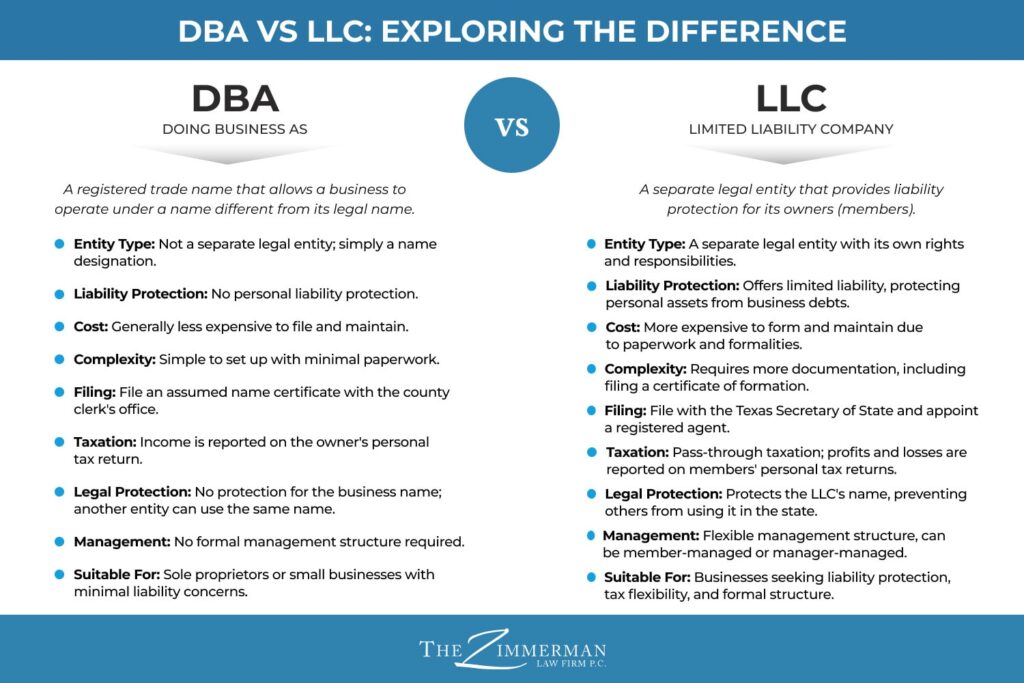

What’s the Difference Between a DBA and an LLC in Texas?

A DBA in Texas allows a business to operate under a different name, while an LLC creates a legally separate business entity.

LLCs offer limited liability protection to their owners, shielding personal assets from business debts and lawsuits. They require more formalities and paperwork but provide pass-through taxation and flexibility in management. A DBA is not a business structure or entity; instead, it’s a registered trade name that allows a business to operate under a name different from its legal name.

This distinction is crucial because while an LLC is a separate legal entity that provides limited liability protection to its owners, a DBA is more of a branding tool that doesn’t offer the same legal protections. They are simpler and less expensive to establish but offer no legal protection for the business name.

Choosing Between a DBA and an LLC in Texas

There are several factors to consider when deciding between a DBA and an LLC in Texas, including:

- Liability protection. An LLC may be more suitable than a DBA if you want to protect your personal assets from business debts and lawsuits. Separate business entities like LLCs and corporations offer more legal protections than a DBA.

- Cost and complexity. DBAs are generally less expensive and easier to set up and maintain than LLCs, which involve more paperwork and formalities. Small businesses or sole proprietors may choose this option.

- Brand identity. If establishing a distinct brand identity is an important aspect of your business goals, a DBA can help achieve this as it gives you more creativity and control over the name you present to the public.

- Tax implications. LLCs offer pass-through taxation, while DBAs are typically taxed as part of the owner’s personal income if they are sole proprietors.

Whether you choose to establish an LLC or file for a DBA, it is a good idea to consult with an experienced business formation attorney to review your goals and ensure you are giving your venture the best chance of success.

Call (254) 752-9688 or complete the free case evaluation form below

Start Your Texas Business on the Right Foot with Experienced Business Formation Attorneys

Starting your own business can be exciting and daunting, but you can trust The Zimmerman Law Firm’s experienced business formation attorneys to guide you through every step.

With years of experience helping Texas entrepreneurs, our team can navigate you through the formation or registration process, enabling you to concentrate on achieving your goals. Call us to schedule a consultation, or fill out our contact form to get in touch.

[Related] How to Start a Sole Proprietorship in Texas

Where You Can Find Our Waco, TX Office